DON'T BE HELD CAPTIVE

Find out why unbiased advice is an important part of a comprehensive integrated wealth management plan.

ENHANCE YOUR WEALTH IQ

Improve your wealth IQ in just minutes by reading through key questions and answers related to wealth management.

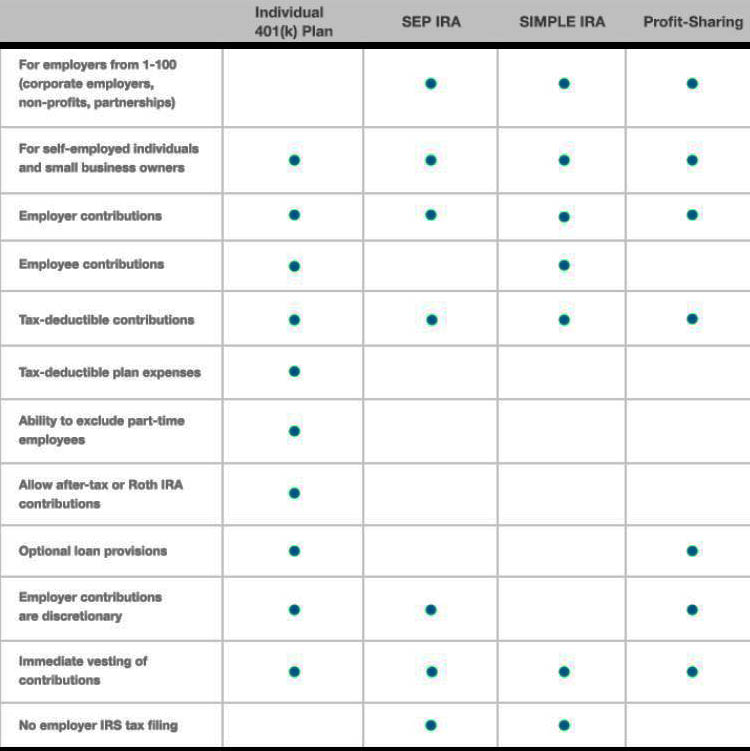

What retirement plan is the right

fit for your business?

Whether

you’re self-employed and need to fund your own retirement or a

small business owner looking to create a sound financial future

for you and your employees, SPM offers a variety of retirement

plans to fit your needs.

Whether

you’re self-employed and need to fund your own retirement or a

small business owner looking to create a sound financial future

for you and your employees, SPM offers a variety of retirement

plans to fit your needs.

There are several types to choose from and the options can be

confusing. For example, some retirement plans are better suited

for sole proprietors, while others are more appropriate for

businesses more employees. Experts estimate that Americans will

need 70 to 90 percent of their preretirement income to maintain

their current standard of living when they stop working. So now

is the time to look into retirement plan programs. As an

employer, you have an important role in helping America’s

workers save.

Many small-business owners say they want to set up a 401(k) plan

because that is the plan they are most familiar with ... however

after analysis of the choices available ... another plan type,

such as a SEP IRA or a Self-Employed 401(k), may be more

appropriate.

Compelling reasons why businesses

start retirement plans

You want to help secure your future and that of your employees.

You want to help secure your future and that of your employees.

Offering a retirement plan can help your business attract and

keep employees.

Offering a retirement plan can help your business attract and

keep employees.

Plus there are potential tax benefits to offering a plan

Plus there are potential tax benefits to offering a plan

Common retirement plans business

owners implement

Simplified Employee Pension Plan (SEP IRA)

Simplified Employee Pension Plan (SEP IRA)

Savings Incentive Match Plan for Employees (SIMPLE IRA)

Savings Incentive Match Plan for Employees (SIMPLE IRA)

Self-Employed 401(k) plan

Self-Employed 401(k) plan

401(k) plans for larger companies or 403(b) plans for

non-profits

401(k) plans for larger companies or 403(b) plans for

non-profits

Non-Qualified Deferred Compensation Plans

Non-Qualified Deferred Compensation Plans

For many Employee Retirement Plan Participants … that journey

begins with enrolling in their company’s retirement plan whether

it is a 401k, 403b or other defined contribution plan. Having a

team working for them enables participants the freedom to invest

with confidence in their future. As you consider the specific

features of each plan please feel free to reach out to Select

Portfolio Management, Inc for assistance in this very important

business decision.

SPM Business Retirement Planning

Solutions include:

SEP IRA

SEP IRA

SIMPLE IRA

SIMPLE IRA

401(k)

401(k)

403(b)

403(b)

457(b)

457(b)

Defined Benefit Plans

Defined Benefit Plans

Defined Contribution Plans

Defined Contribution Plans

Profit-Sharing Plans

Profit-Sharing Plans

Qualified and Non-Qualified Deferred Compensation Plans

Qualified and Non-Qualified Deferred Compensation Plans